Menu

Fees Information

As a discretionary account manager, LDIC charges a management fee on a quarterly basis. When you open your account you may elect to be on a flat fee or performance fee schedule.

Fees Explained

LDIC offers a competitive management fee to manage your portfolio. Currently our clients have 2 options on the fees schedule: Flat Fee option or Performance Fee option.

To understand more details on how the management and performance fee will impact your performance, please refer to LDIC Client Relationship Disclosure, section ‘ What are LDIC’s fees?’.

In addition to LDIC management fees, there are commissions charged for each trade (buy & sell) completed in the account based on your custodian commission structure. LDIC will provide a detailed commission table when you open accounts with us. Mutual funds or ETF’s held in your account may also have a Management Expense Ration (MER) which is charged by the mutual fund manager within the fund on a pro rata basis.

All mutual funds and LDIC investment fund’s management fees are excluded from your portfolio fees calculation.

Performance fee – Hurdle Rate & High Water Mark (HWM)

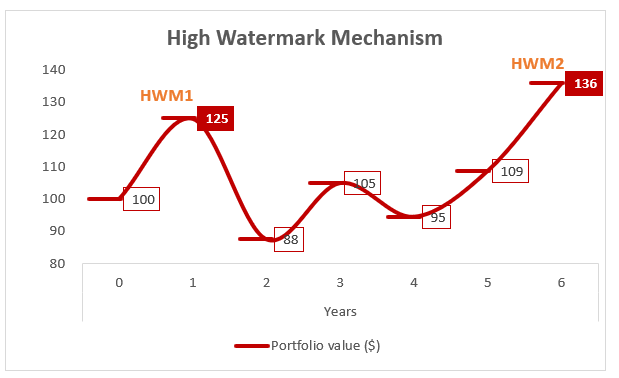

In 2019 October, LDIC introduced and initiated a high watermark hurdle rate of 8% on our performance fee option. This means LDIC will charge a performance fee based on two scenarios: 1) +8% absolute annualized return based on client’s portfolio anniversary month, 2) the total portfolio value must also be higher than the highwater mark. The high watermark is your portfolio’s previous highest market value since 2019 October.

Below table illustrates our high watermark Mechanism

At the end of year 1, the first high watermark was set since the portfolio performed in excess of 8% hurdle (HWM1) , despite double-digit positive performances in the years 3 and 5, the performance fee is not earned by the portfolio manager, since the client’s asset is below the high watermark set at the end of year 1. It is only at the end of year 6, the portfolio achieved a performance level above the year 1 or previous highwater mark set. and therefore, a performance fees is earned in year 6 (HWM2)

Hence, the high watermark hurdle rate protects client’s assets from performance fee on performance earned. The result, feasibly a lower cumulative performance fee than the old fee structure, without the high watermark.

At LDIC Inc., we are committed to be transparent on our fees as clear as possible, and follow the best practices in wealth creation and preservation of our clients’ assets.

Tax Deductible Fees

Any fees charged directly to the client in a non-registered account are tax deductible. All fees charged in registered investment accounts are not tax deductible. It is advisable to have registered fees charged in registered plans, as you are paying fees with pre-tax dollars and therefore paying a lesser fee than if it was paid with after-tax dollars.

LDIC Inc. is registered as a Portfolio Manager in all provinces within Canada except for Newfoundland, New Brunswick and Nova Scotia and an Investment Fund Manager registered in Ontario, Quebec and Newfoundland. The materials presented in this web page are for general information purposes only and do not constitute an offer to buy or sell securities. Third party information provided herein has been obtained from sources believed to be accurate, but cannot be guaranteed. The information and opinions expressed herein are current as of the date of this document and LDIC Inc. assumes no obligation to provide updates or advise on further developments. Any personal opinions presented by individuals here in are the views and opinions of the individual and not necessary the views of LDIC Inc. Unauthorized publication or re-distribution of these materials may be illegal; please contact LDIC Inc. for permission prior.