Menu

TFSA’s Explained

The Tax Free Savings Account (TFSA) is a great investment vehicle to assist you in saving for your short or long-term financial goals.

Contributors

The TFSA program began in 2009 and is a great way for Canadian residents to accumulate and grow assets tax-free. Non-registered investment accounts attract interest, capital gains and dividends, however these types of income are not taxed in the TFSA. Sheltering your savings in a TFSA can provide a great advantage for growing funds for your future financial goals.

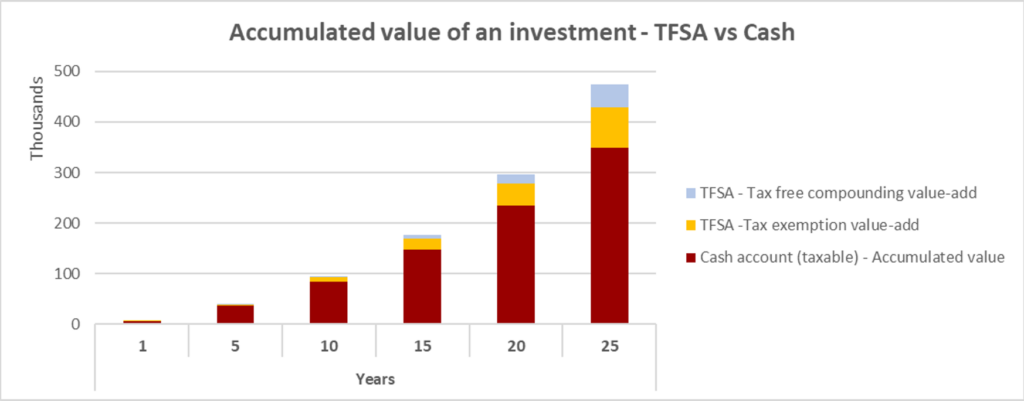

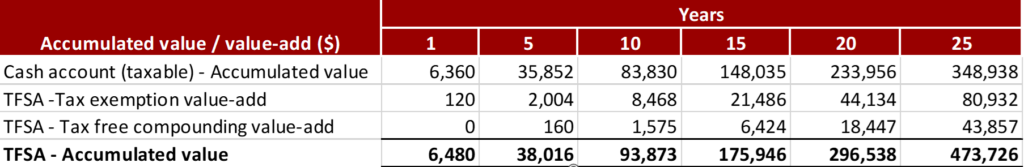

The below table shows the value-add that comes from the tax-exemption and the compounding effect of the tax-exemption over time. The TFSA’s accumulated value is more than 36% of the accumulated value of a non-registered taxable account.

If you are saving for a rainy (or snowy) day, have maxed out your RRSP or do not have contribution room, a TFSA is a great way to invest your available funds and allow them to grow tax free. If you have a RRIF or LIF account and have excess retirement or pension income, these funds can be moved into the TFSA to allow the funds to continue to grow over time. TFSA’s are also a great way for parents or grandparents to help young adults establish savings and gift funds to them for their future.

If you already have a TFSA, but haven’t made a contribution in 2022, please reach out to the LDIC Client Relations department and we can assist you in making a TFSA contribution. If you don’t yet have a TFSA, we would be pleased to assist you in setting up a new account.

We hope you find the below information helpful and look forward to discussing with you further!

What is a Tax Free Savings Account?

A TFSA is a registered investment account that allows you to grow and withdrawal your money tax-free.

Who can open a TFSA account?

All Canadian residents who are 18 years or older with a valid Social Insurance Number are eligible to open a TFSA.

If I become a non-resident can I keep my TFSA and still contribute?

You may keep your TFSA, however you aren’t eligible to contribute or accumulate contribution room until you become a Canadian resident again.

What are the benefits of a TFSA?

TFSA account holders benefit from the ability to grow their assets without taxation on capital gains, interest and dividend income or on the withdrawal of funds. A TFSA is a great option if you have existing non-registered assets that you would like to shelter from tax. By moving these assets into a TFSA you create a more tax-efficient portfolio and can maximize your investment growth.

TFSA’s can be utilized to save for a special occasion or future purchases. If you have maxed out your RRSP contributions or are now retired and without contribution room, you can take advantage of a TFSA for tax free growth of your excess funds.

If you have a RRIF or LIF account with an annual required minimum withdrawal and don’t have an immediate use for the funds, a TFSA provides a great vehicle to reinvest excess RRIF or pension income and allow the funds to continue to grow over time.

TFSA’s are also a great way for parents or grandparents to help young adults establish savings and gift funds to them for their future. You can make a TFSA contribution for a spouse or other family member and it doesn’t affect your contribution room.

How much can I contribute to my TFSA?

In 2022 the TFSA contribution maximum in $6000. Any unused contribution room from one year can be carried forward indefinitely.

If you were 18 or older in 2009 and have never made a TFSA contribution, you have a lifetime contribution maximum of $81,500 in 2022.

If you have withdrawn funds from your TFSA, any amount withdrawn can be re-contribute in the next calendar year following the withdrawal. In other words, if you withdrew $100,000 in 2021, you can recontribute $100,000 in 2022, plus the 2022 TFSA contribution maximum of $6000.

If you have a TFSA and/or have made contributions in the past, and want to verify your exact available contribution room, please call CRA or visit the online CRA portal.

How does a TFSA different from an RRSP?

While an RRSP is a registered account that helps Canadian’s plan for retirement, a TFSA is a registered vehicle that can help save for future goals and expenses. Although both types of accounts allow Canadians to grow their assets tax free, an RRSP contribution creates a tax deduction where a TFSA contribution is not tax deductible. RRSP withdrawals are also seen as income and therefore taxable, where as a TFSA withdrawal is not considered income and therefore not taxable.

Can I withdrawal from my TFSA?

TFSA withdrawals can be made at any time. If you withdrawal from your TFSA, you don’t lose your contribution room and may re-contribute the amount withdrawn in the following calendar year or any year after.

What happens to my TFSA when I die?

TFSA’s allow for beneficiaries to be elected, similar to RRSP’s. In the event you elect your spouse as the TFSA beneficiary, the TFSA assets can rollover into the spouses TFSA tax-free or without withholding tax. This also provides the benefit of avoiding probate taxes on these assets. If you elect another beneficiary, the assets will also be paid out directly to the beneficiary and avoid probate.

I’ve already opened a TFSA at LDIC. How do I make contributions?

- You may make an online banking payment, similar to paying a bill. Please confirm your custodian and account number with Client Relations to set up the payee in your online banking profile.

- You may send a cheque payable to your custodian (NBIN Inc. or BMO Nesbitt Burns) to the LDIC office.

- If you have a non-registered account, you may direct Client Relations to transfer funds from this account. If you have a RRIF or LIF and would like your minimum payment or part of the payment moved into a TFSA, please advise Client Relations and they can ensure funds are deposited to the TFSA.

I have a TFSA at another institution. How do I transfer to LDIC?

If you would like to transfer your TFSA to LDIC, please send a copy of your statement to Client Relations and we will prepare a transfer form to be electronically signed and then submitted to the relinquishing institution.

Source: Government of Canada

LDIC Inc. is registered as a Portfolio Manager in all provinces within Canada except for Newfoundland, New Brunswick and Nova Scotia and an Investment Fund Manager registered in Ontario, Quebec and Newfoundland. The materials presented in this web page are for general information purposes only and do not constitute an offer to buy or sell securities. Third party information provided herein has been obtained from sources believed to be accurate, but cannot be guaranteed. The information and opinions expressed herein are current as of the date of this document and LDIC Inc. assumes no obligation to provide updates or advise on further developments. Any personal opinions presented by individuals here in are the views and opinions of the individual and not necessary the views of LDIC Inc. Unauthorized publication or re-distribution of these materials may be illegal; please contact LDIC Inc. for permission prior.